Introduction

Starting a business is a fascinating trip but also a demanding one. Funding is among the main obstacles aspirant business owners must overcome. Everything requires money—renting office space, purchasing tools, or starting a website included. For this reason, Business Start Up Loans will be quite valuable in 2025.

These loans, which provide both financial support and confidence to advance, are especially meant to assist startup companies get momentum. This article will show how, step-by-step, Business Start Up Loans can transform your entrepreneurial dream into a real, profitable business.

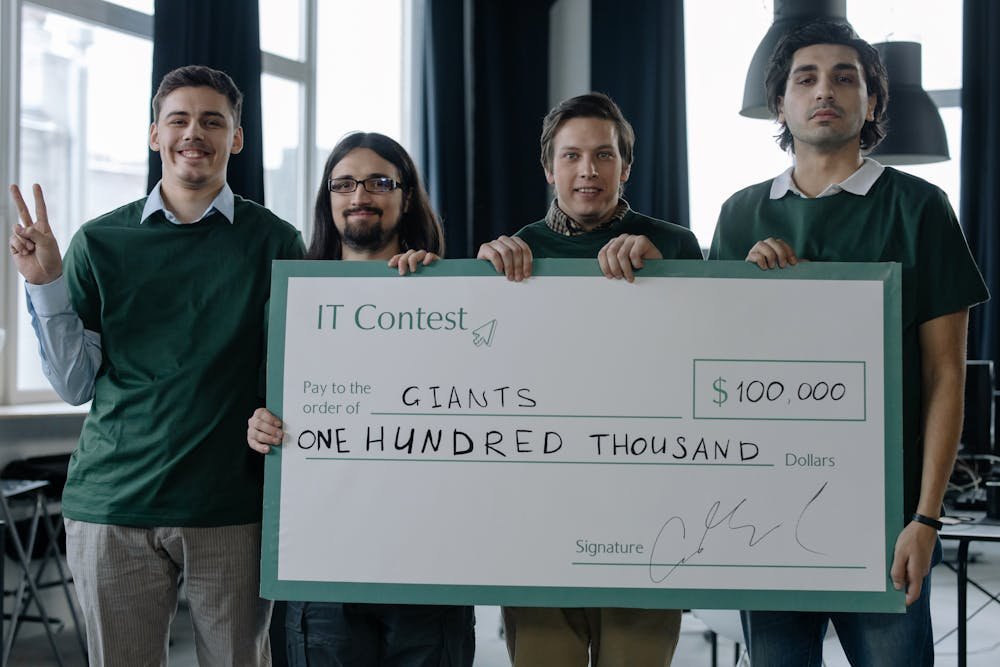

A Real-Life Spark: Tony

Tony’s dream was of opening his own mobile app development company. He has the knowledge, the will, and a great idea to assist small companies in controlling their web footprint. One problem, though, was that he lacked the funds to create a suitable staff or sell the goods.

Tony searched the internet and then applied for a Business Start Up Loan via a digital lender. In a few weeks, he got $25,000. He hired his first developer with that cash, bought tools, and started a website. Tony’s app today boasts over 50,000 downloads; it all began with the appropriate loan. Whether you’re starting a mobile app development company or a retail business, securing the right Business Start Up Loans is crucial for covering initial costs and fueling growth.

Why Would One Choose Business Start-Up Loans?

- You could question, “Why not just use personal savings or borrow from friends and family?” These loans offer the following reasons as a better choice:

- Unlike unofficial borrowing, loans have defined conditions and payback schedules.

- Repaying a loan on schedule will assist your business credit score grow, which is crucial for future funding.

- Many banks provide business advice, tools, and mentoring along with financing.

- 2025 also is a perfect time to apply. Access to company Start Up Loans has never been simpler thanks to fintech and peer-to–peer lending platforms—even for those with little or no company experience.

Knowing the Various Business Start-Up Loan Types

Let us more precisely dissect your choices:

1. SBA Microloans

These government-backed loans, which run up to $50,000, are passed through nonprofit community lenders. Perfect for companies with modest capital requirements.

See further information at the Small Business Administration (SBA).

2. Online Loans for Business

These quick, paperless loans, offered by sites like BlueVine or OnDeck, are typically authorized in 24 to 48 hours.

3. Starting Credit Lines

For regular expenses or crises, this provides flexible access to credit rather than a flat sum, perfect.

4. Equipment Funding

Should your startup depend on tools, computers, or machinery, this financing allows you to finance the equipment itself as collateral.

5. Corporate credit cards

Though not strictly a loan, a useful starting point for small purchases, temporary requirements, or early company credit building.

Understanding the various Business Start Up Loan types is crucial for choosing the right funding option for your startup. Let’s explore the available choices and how each can support your business goals. And if you’re planning long-term financial strategies beyond your business, such—estate planning, you might also be interested in learning how the Residence Nil Rate Band reduces inheritance tax.

Comprehensive Guide on Obtaining a Business Start-Up Loan

Although it sounds scary, obtaining a loan is not so difficult. The smart way is as follows:

1 . Clearly state your vision.

Clearly state the activities of your company and the issue it addresses. Your argument to lenders starts with this.

Write a Business Start-Up Loans Plan

Creating a solid loan plan is essential for convincing lenders that your business is worth the investment. Your plan should include:

- Summary of Executive Notes – A brief overview of your business, goals, and what makes your idea unique.

- Examination of the Market – Research on your target audience, competitors, and market trends.

- Marketing Plan – How you plan to attract and retain customers, including advertising strategies.

- Financial Anticipations – Realistic income, expense, and profit projections over the next 1–3 years.

- System of Repayment – How and when you intend to repay the loan, including cash flow forecasts.

3. Review your financial situation.

You might find use for your credit score, debt-to-income ratio, and savings history. Watch your score with free programs like Credit Karma.

4. Pick a leaner.

Check credit unions, internet lenders, and conventional banks. Some especially target firms are run by women or minorities.

5. Get ready with documentation.

- Usually, you’ll need:

- business strategy

- Both personal and business start-up loans tax returns

- Forecasts of profit and loss

- Statements of banks

- Personal Identifier

6. The step should be a wise application.

Apply concurrently to two to three lenders to evaluate offers. Steer clear of applying too often as this could damage your credit.

7. Make Wise Use of the Funds

Sort money according to a well-defined budget. Unless required, avoid overspending on vanity projects, including expensive office space.

Advice on Raising Your Loan Approval Prospects

- Start modest: Apply for a reasonable amount first.

- Work with a mentor; join free programs like SCORE for professional advice.

- Correct your credit. Before applying, pay off debt and correct credit problems.

- Create business credibility even with small freelancing projects.

Traps to steer clear of

- Approaching a loan requires a significant commitment. Use caution with:

- Predatory lenders with sky-high APR “no-doc” loans.

- Overborrowing only because you qualify for more.

- Ignoring repayments could damage your business credit.

- Read the whole terms and conditions. If something seems strange, back away.

Options Other Than Business Start-Up Loans

- A startup can be financed from sources other than loans. Imagine:

- Grants: Free money available through local initiatives or Grants.gov

- Indiegogo and other sites enable your audience to help you realise your project.

- Give money, mentoring, and networking chances for incubators and accelerators.

- If loans match your company strategy, these can either augment or even replace them.

FAQs

Can I get a Business Start Up Loan with bad credit?

Yes, but it may be more challenging. Some online lenders and microloan programs offer options for people with fair or poor credit, especially if you can show strong business potential or offer collateral.

How much money can I borrow as a start-up?

Loan amounts can range from $1,000 to $500,000, depending on the lender and your qualifications. Most new businesses get loans in the $10,000–$50,000 range to cover early-stage costs.

How do I apply for a Business Start Up Loan?

To apply, you’ll typically need:

A detailed business plan

Personal and business financial documents

A good credit score

A clear explanation of how you’ll use the loan

You can apply through a bank, credit union, or online lender like Lendio.

How long does it take to get approved?

Approval times vary. Traditional banks may take 2–4 weeks, while online lenders can approve and fund loans in as little as 24–72 hours.

Final Thought:

Every large corporate entity—Amazon, Apple, Airbnb—started small. The variances are.. Their access to money enabled them to fly off.

Business Launch Loans go beyond simply financial considerations. They stand for faith, hope, and financial support of your vision. Whether your project is starting a food truck, launching a fashion brand, or developing a software app, the correct financing will allow you the freedom to concentrate on what matters: creatingexpanding, and prospering.

Given so many easily available choices in 2025, there is no better moment to start that initial step. Your concept is really strong. See to ensure it receives the support it merits.